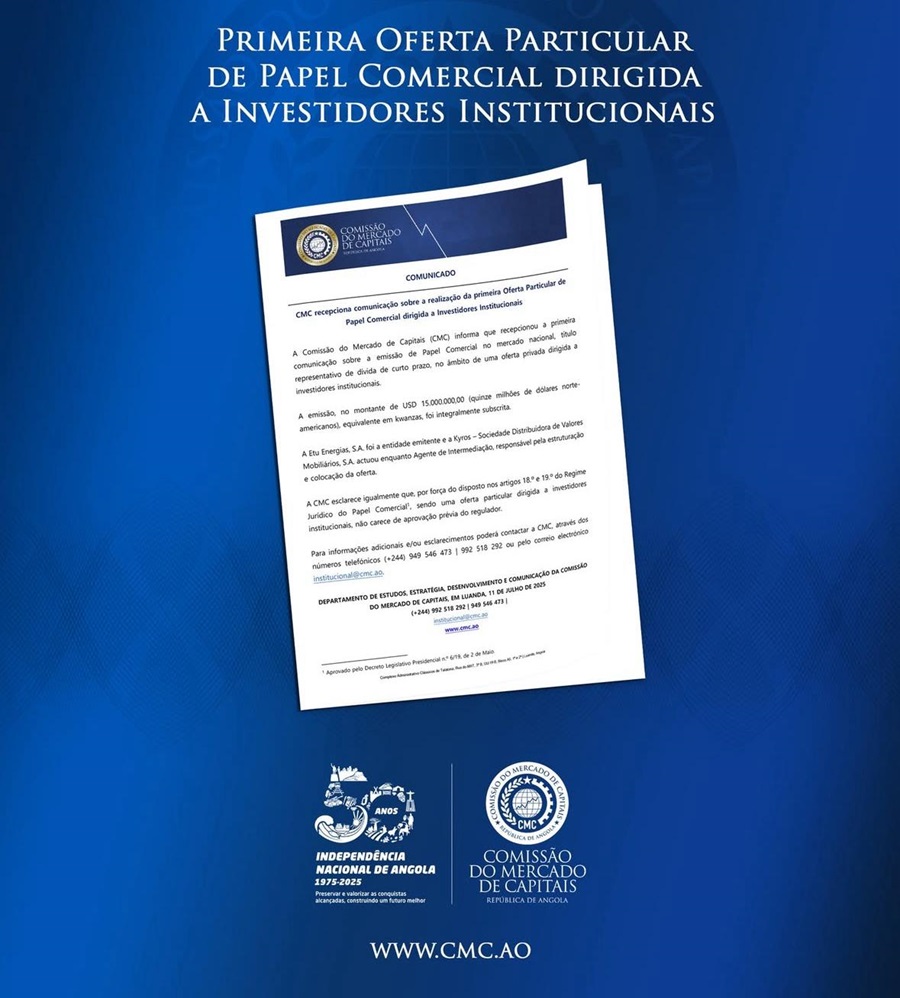

The transaction amounted to USD 15 million (or the equivalent in kwanzas) and was fully subscribed.

The commercial paper, a short-term debt instrument, marks a significant milestone in the development of Angola’s capital markets and strengthens Etu Energias' ability to diversify its funding sources.

We are the first private company to operate in Angola’s energy sector and, as of today, we also become pioneers in issuing this type of financial instrument targeted at institutional investors. This milestone reflects our strategic vision, our commitment to strong partnerships, and the purpose that drives us: to produce energy for Angola’s growth.

The issuance was structured and placed by Kyros – Sociedade Distribuidora de Valores Mobiliários, S.A., acting as the intermediary agent.

According to the Capital Markets Commission (CMC), this transaction falls under a private offering regime, in accordance with Articles 18 and 19 of the Legal Framework for Commercial Paper, and therefore does not require prior approval from the regulator.

With this initiative, Etu Energias reaffirms its position as a dynamic company, committed to innovative solutions in Angola’s financial and energy sectors.